What Are Some Differences Between Gold Coins, Gold Bars, and Goldbacks?

Throughout history, gold has taken many forms: ornate coins in ancient empires, investment bars sitting in vaults, and now Goldbacks circulating in local communities. As more people rediscover gold as money, they might be overwhelmed by their investment options.

What are some of the differences between gold coins, gold bars, and Goldbacks?

Let’s break it down.

What Are Gold Coins?

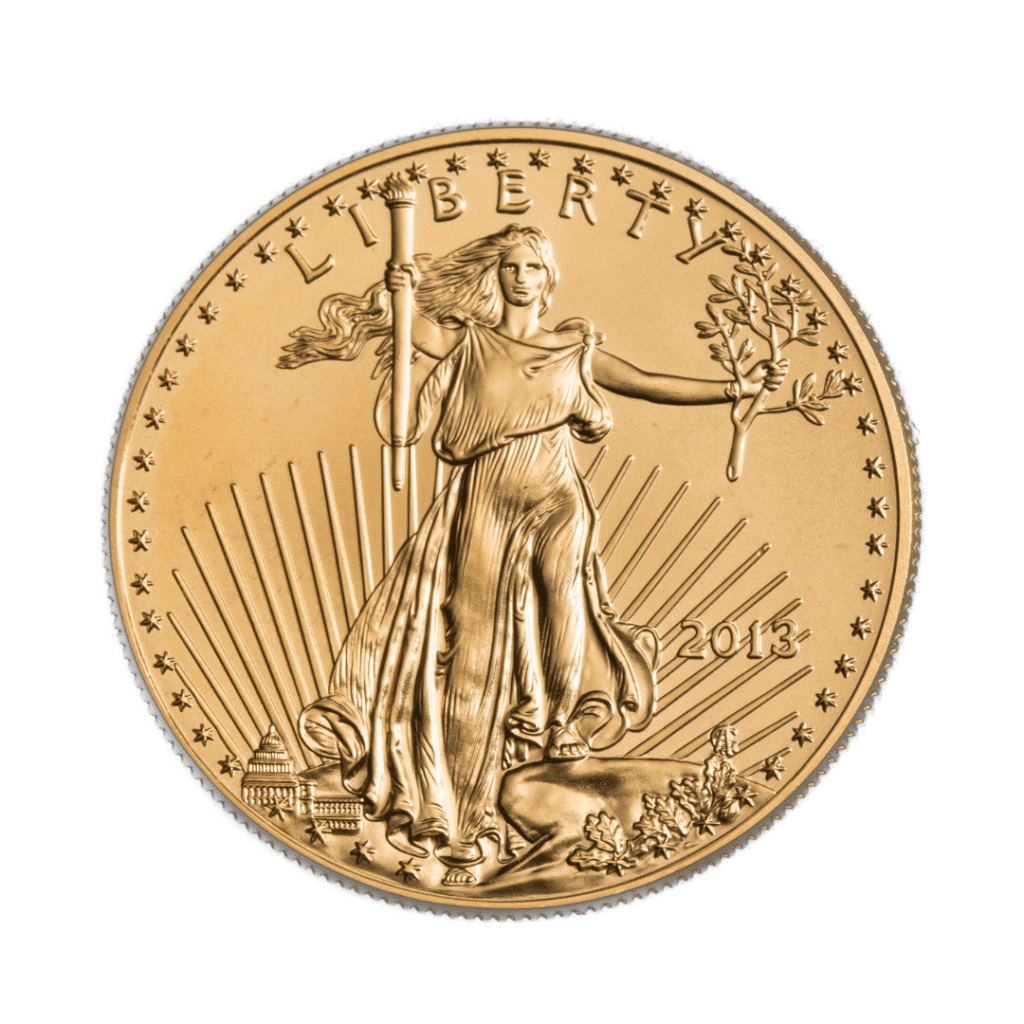

Gold coins are generally minted by governments such as U.S. Gold Eagles or the South African Krugerrand. They’re flat, circular, and typically stamped with national emblems or historical art. However, these coins are designed for investment, not for spending.

Types of Gold Coins

There are two main kinds of gold coins you’ll see on the market:

- Bullion Coins: Minted coins like the U.S. Gold Eagle or Canadian Maple Leaf. These are valued mostly for their gold content and purity.

- Numismatic Coins: Collectible or rare coins that are valued for their age, design, or limited supply. Some coins can fetch hundreds of thousands of dollars from collectors.

Why Do People Buy Gold Coins?

Gold coins are a favorite among collectors and investors who appreciate history and art. But when it comes to spending them, they’re just too valuable for everyday use. Even the smallest coin, like a 1/10 oz Eagle, might represent hundreds of dollars. And the gold content is often worth more than the face value.

In short: gold coins shine brightest as collectibles and investments. They’re not great for day-to-day transactions.

What Are Gold Bars?

Gold bars are the most common form of gold owned by central banks. They are made of 99.9% pure gold. This makes them ideal for investors who want to store large amounts of wealth in a stable asset.

Why Do People Invest in Gold Bars?

- Lowest premiums: Bars often sell close to the spot price of gold.

- Easy to manage: Every ingot is more or less the same, which simplifies storage. Many bars are heavy and may be valued at over $1,000,000 each on gold content alone.

- Global liquidity: They can be sold with the tightest spreads.

However, bars are not designed to move through daily life. You can’t just slice off a chunk when you need some extra change for spending. Selling it usually requires a dealer or appraisal.

What Are Goldbacks?

Goldbacks are a modern gold currency that bridges the gap between storing gold and using it.

How Goldbacks Work

Instead of full-ounce coins or heavy bars, Goldbacks are divided into eight denominations that contain tiny fractions of real 24-karat gold. They make it easy to spend gold on everyday things like groceries, a meal, or an oil change.

Why Do People Use Goldbacks?

- Affordable: Virtually anyone can afford gold in the form of a Goldback.

- Secure: Goldbacks are one form of gold that has never been counterfeited.

- Divisibility: Small, interchangeable units for everyday spending.

- Local Impact: Supports businesses that accept sound money.

Goldbacks are designed to be a form of money that retains value as well as any other gold product. They offer the same inflation-resistance as other forms of gold, which makes them great for saving and spending.

What is Each Type of Gold Used For?

| Type of Gold | Best For | Why It Works |

| Gold Coins | Collecting, gifting, investments | Combines artistry, history, and tangible value |

| Gold Bars | Central banks, hedge funds | High purity, low premium, and maximum liquidity |

| Goldbacks | Savings, local trade, gifting | Fractional, portable, and made of pure 24K gold |

Related Articles

Spend Gold Freely Again: Did We Fix Money?

Written by Kim Coleman, Director of Strategic Relations …

Silverback is Off to a Strong Start! What the Numbers Tell Us

When we announced the return of Silverbacks, we …

A New Silverback is Coming!

If you’ve been part of the Goldback community …

GILD Community Corner: The Goldback Merchant Network Has Grown 75% This Year!

Written by Phil Eborn, Director of Community November …