The Goldback Lease Program

Lease your Goldbacks back to us and earn monthly interest payments in Goldbacks! By joining the lease program, you grow your investment, avoid vaulting fees, and support the production of our gold-backed currency.

How It Works

STEP 2

Lease Your Goldbacks

Choose the number of Goldbacks you want to lease, starting as low as 10 Goldbacks.

STEP 3

Earn Monthly Returns

Earn annual returns of 2% to 3%, depending on the size of your lease. Fractional lease return payments are made into accounts monthly in the form of Goldbacks.

Earn Gold on Your Gold

The more Goldbacks you lease, the more Goldbacks you earn, making this program an ideal way to grow your investment.

- Goldbacks

- US Dollars

Goldback Account*

Lease Size

Goldback

Earned Return

10-29,999

2% / yr

30,000-74,999

2.5% / yr

75,000+

3% / yr

* Goldback Accounts are serviced by the Alpine Gold Exchange.

Goldback Account*

Lease Size

Goldback

Earned Return

$67.20-$201,593.28

2% / yr

$201,600-$503,993.28

2.5% / yr

$504,000+

3% / yr

Note: The Goldback Lease Program is only available in Goldbacks. The USD values are references only. The Goldback Exchange Rate changes daily and is currently $5.44 / Goldback.

* Goldback Accounts are serviced by the Alpine Gold Exchange.

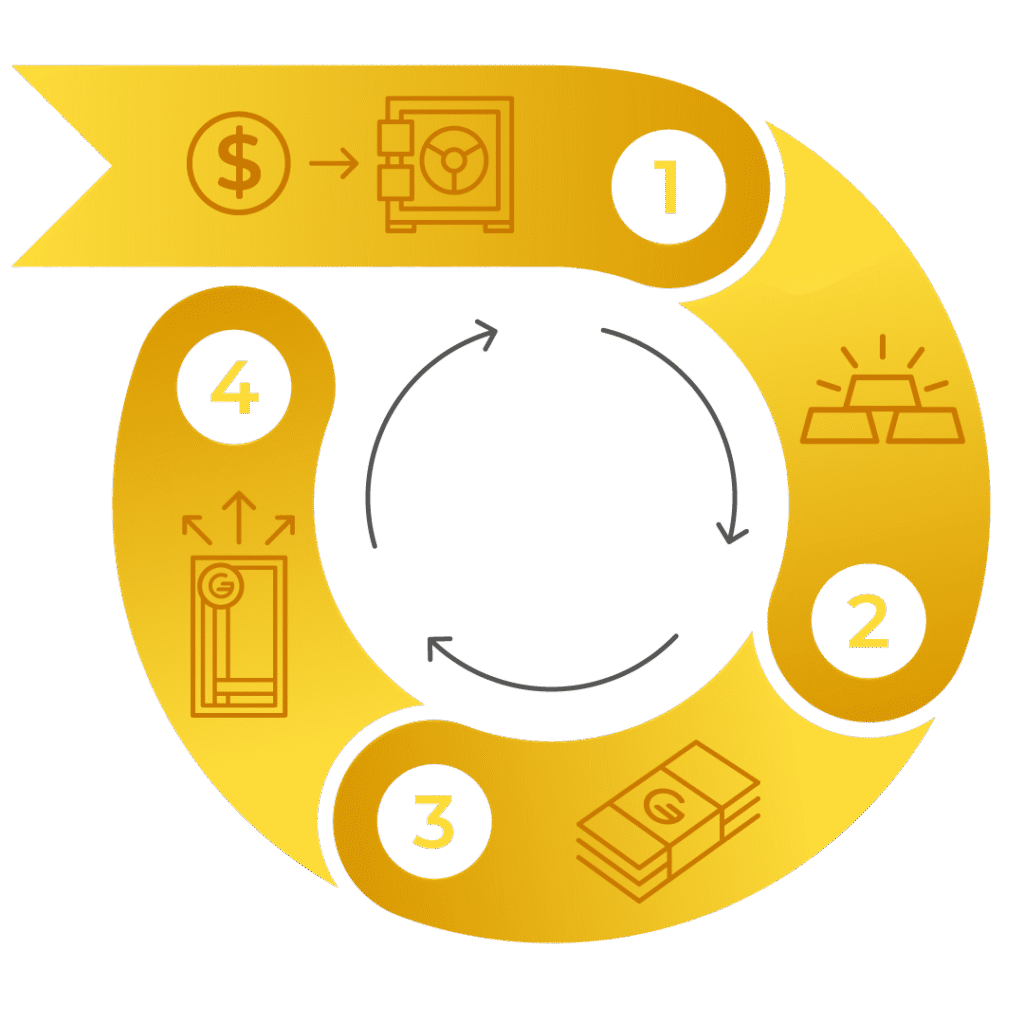

Goldback Lease Cycle

Open & Lend

You open a lease and lend funds to Goldback.

Purchase Materials

Those funds are used to purchase raw gold.

Manufacture

The gold is used to create new Goldbacks.

Distribute

You receive Goldbacks as a return on your investment.

Benefits of Leasing

Earn Returns

Generate a steady income from your Goldbacks without selling them or accumulating vaulting fees.

Preserve Your Wealth

As gold prices rise, so does the value of your returns, offering an inflation-resistant way to preserve your wealth.

Secure Your Investment

Your leased Goldbacks are fully insured, giving you peace of mind.

Sponsor a New State Series

Support new regional series by investing in a Goldback sponsorship through the lease program. More information coming soon.

Goldback® Lease FAQs

Do I need to be an accredited investor?

No. Goldback leases are not securities since they represent a physical product that you own, and are leasing to Goldback Inc. under a defined agreement.

How long is the term of the lease?

Small leases managed through AlpineGold.com can be terminated at any time. Larger leases may take up to 60 days to terminate. State Sponsorship leases generally have a minimum time of a year.

What happens when the lease ends?

When the lease ends you may choose to let it automatically renew or liquidate on 60-days notice. Liquidating the lease may involve either taking physical delivery of the Goldbacks, having them vaulted, or having them sold for cash or traded for another precious metal. Most people choose to renew leases because of the attractive income stream.

What kind of paperwork is involved?

There is a simple lease agreement that we can email you. You can expect that we may ask some questions related to “know your client” protocols.

Where can I get more information?

You can reach out to Alpine Gold to learn more about Goldback Leases.

Goldback Lease Program Background

The Goldback Lease Program is designed to give excellent and safe returns in an environment where everyone is being forced to compete with extremely cheap credit. The main investment is actually held in gold, the returns are also paid in gold on a monthly basis. Our lease program has grown from about $1.5 million in 2019 to $11 million in 2022. It protects Goldback Inc. from bank credit demands while allowing people to put their gold to work for them in a secure and meaningful way.

Before Goldbacks were first produced in 2019, we had a challenge. We learned that it would cost over one and a half million dollars to make all of the inventory necessary to lock in favorable production rates with our production company, to make the Goldback affordable. Once sold, this same one and a half million dollars worth of Goldbacks would then need to be reordered so that we could continue providing Goldbacks. We would never be able to spend this money on development. As Goldbacks became more popular we would need even more circulating inventory and capital.

As a new company, Goldback Inc. didn’t have that kind of money sitting around. Our solution was to work with our partners to borrow the gold in the form of gold leases. In exchange for the loan, we agreed to pay an annual return in gold. All of the leases are denominated in Goldbacks. Maximum return is 3.5%.

Goldback Leases are popular because, rather than paying vaulting fees, one can make a return on gold. This is attractive because the value of the loan increases as the price of gold rises. The entire lease is held in gold at all times and is insured against loss or theft. The gold is used for the creation of new Goldbacks which are then sold to retailers. Once sold, the Goldbacks are reordered with the same money, providing a rotating inventory. As the demand for Goldbacks continues to grow and production capacity increases, we are growing this program as well.

I’m Interested . . .

Get Started!

Getting started is simple! Visit Alpine Gold Exchange to open an account and begin leasing your Goldbacks today.